Dear reader,

The tech sector has a new set of magic words: free cash flow. Even Uber, king of cash burn, is feeling the heat.

“We need to show them the money,” wrote Uber chief executive Dara Khosrowshahi in a memo obtained by the Financial Times. It is an extraordinary message. Oh, NOW Uber needs to prove it can make money? What happened in the previous 13 years?

The question of whether public markets are entering a sustained downturn has focused minds here in San Francisco. If central banks put a definitive end to the era of low rates that made money so cheap, the question is whether growth companies with high valuations will deflate to reasonable levels, or just crash and burn.

Hence the focus on grown-up metrics such as free cash flow, or what’s left over after any investing. Shares in electric car company Tesla are down 39 per cent this year. But speaking at the FT’s Future of the Car conference this week, boss Elon Musk said that his company had a bright future “and I think we will throw off a tremendous amount of free cash flow”.

But what do companies do when they have no clear path to profitability? Denver-based data analytics company Palantir tried to get around the problem by riffing on the state of the world.

Markets were not convinced. Its slowing revenue growth does not back up Palantir’s claim of thriving in good times and bad. Shares are down 61 per cent in the year to date. Lex thinks it will require a near-term forecast date for positive net income before Palantir’s shares recover.

New York-based meal-kit delivery service Blue Apron remains profitless after 10 years. This week, it had an even more worrying number to report — sales are half the level they were when it listed in 2017. Lex wonders why RJB Partners is investing $40mn in a private placement. Perhaps it will take the stock private but its behaviour so far has been odd.

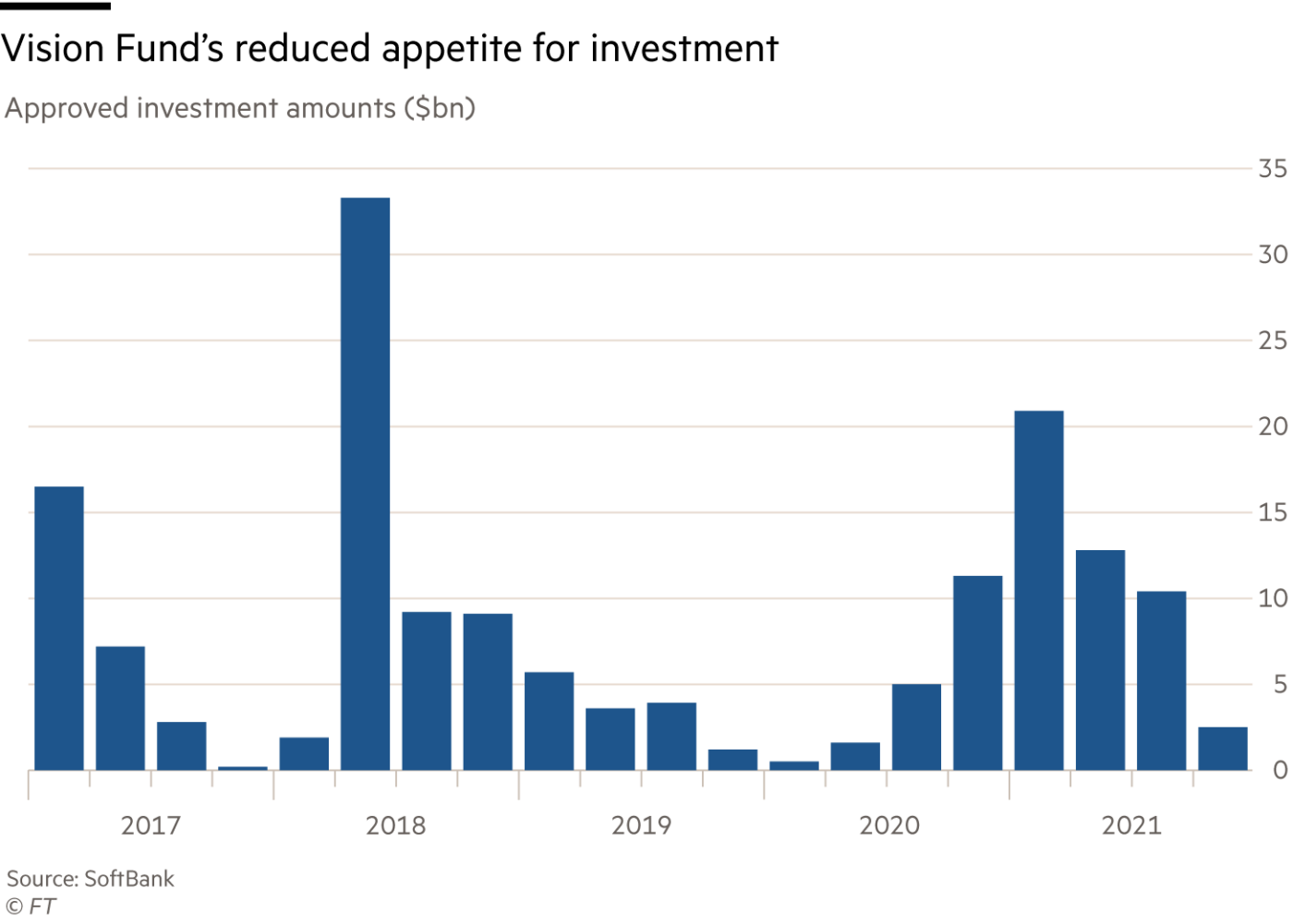

At Japanese technology investment group SoftBank, which has contributed to high tech valuations, Masayoshi Son has put the brakes on its investment pace. Annual net loss has reached ¥1.7tn ($13bn). Lex is curious about what will happen now to the $50bn in capital that has been earmarked for investments.

Lex does applaud founder Son for diversifying away from China as crackdowns increase. The possible US delisting of Chinese online housing platform owner KE Holdings has also encouraged Son to list it in Hong Kong. That will improve liquidity but do little to solve the real problem: China’s faltering property market.

Dating app Bumble is still hung up on using adjusted ebitda — but at least sales are growing. Lex is intrigued by the success of its acquisition of France’s Fruitz, which matches users via the medium of fruit. But adding more users via acquisitions will never take Bumble close to the almost 100mn users that Match boasts. Bumble shares are down 38 per cent so far this year.

Crypto investors have a much harder time pointing to a metric that might support prices. Bad news for US-listed cryptocurrency exchange Coinbase, whose price is firmly tethered to the fortunes of bitcoin, the largest cryptocurrency. Traders are being warned they could lose all of their crypto assets if the company goes bankrupt — a reminder that this sector lacks the safety net of banks.

Speaking of tethered assets — the not-so stablecoin tether fell below the US dollar to which it is meant to be pegged. US Treasury secretary Janet Yellen has called for stablecoin rules and says there is a risk of financial instability. Lex agrees that if Tether liquidates its $34bn Treasury holdings or $24bn of corporate debt there will be market repercussions. That’s if those numbers are correct. We also point out that Tether has been in trouble over its claims before.

Rising rates may spell doom for risky assets but European banks should be happy. Think again. At just over seven times forward earnings, Lex thinks the sector does look cheap but prone to credit risk should recession take hold in the next year.

Tangible assets are still rising in price though. Lex wonders if Andy Warhol prints offer an inflation hedge. Over the long term, prices have beaten inflation. But, of course, the pool of buyers is small and susceptible to impulse spending.

Perhaps chipmakers are a better bet. Integrated device manufacturers such as Infineon and Samsung are busy completing back orders pushed higher by snagged supply chains. Gartner expects a 13.6 per cent increase in global semiconductor revenues this year.

Russia is thinking carefully about its own supply chains as the EU threatens an oil embargo. Hungary wants a carve-out but, even with exemptions, Lex says an EU ban would have clout. Russia’s ability to replace its main customer will be hit by transport constraints. Energy prices are already rising amid the quarrel. Household bills too. Companies such as Centrica may find it increasingly hard to justify raising shareholder rewards, but the UK energy group will probably do so, believes Lex.

Oil market turmoil could accelerate the transition to clean energy. Shareholders are putting more pressure on global companies to make the change. Not BlackRock, though. The goliath of fund management is swerving some climate change resolutions. But as Lex points out, this is not such a radical decision. BlackRock supported less than half of environmental and social shareholder proposals last proxy season. Still, it is an unwelcome step back.

Enjoy your weekend,

Elaine Moore

Deputy Head of Lex

If you would like to receive regular updates whenever we publish Lex, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage